Tracking Intercompany Transactions

In one of the previous blog posts Consolidation for Dummies, we addressed financial consolidations, the purpose of which is to merge financial statements of multiple business units into a consolidated financial statement of a parent company. Intercompany transactions are related to consolidations; these are financial transactions that can occur between a parent company and its divisions or child companies and which can but should not have an impact on the consolidated financial statement. While companies that belong to one group (parent company) record and reflect all transactions, including intercompany ones, independently, for the consolidated parent company, these transactions never actually happen, since the resources do not go outside the consolidated company. These are also referred to as arm-length transactions. At the point of consolidating financial statements, the accountants must be able to define intercompany transactions and eliminate their impact on the financial statements.

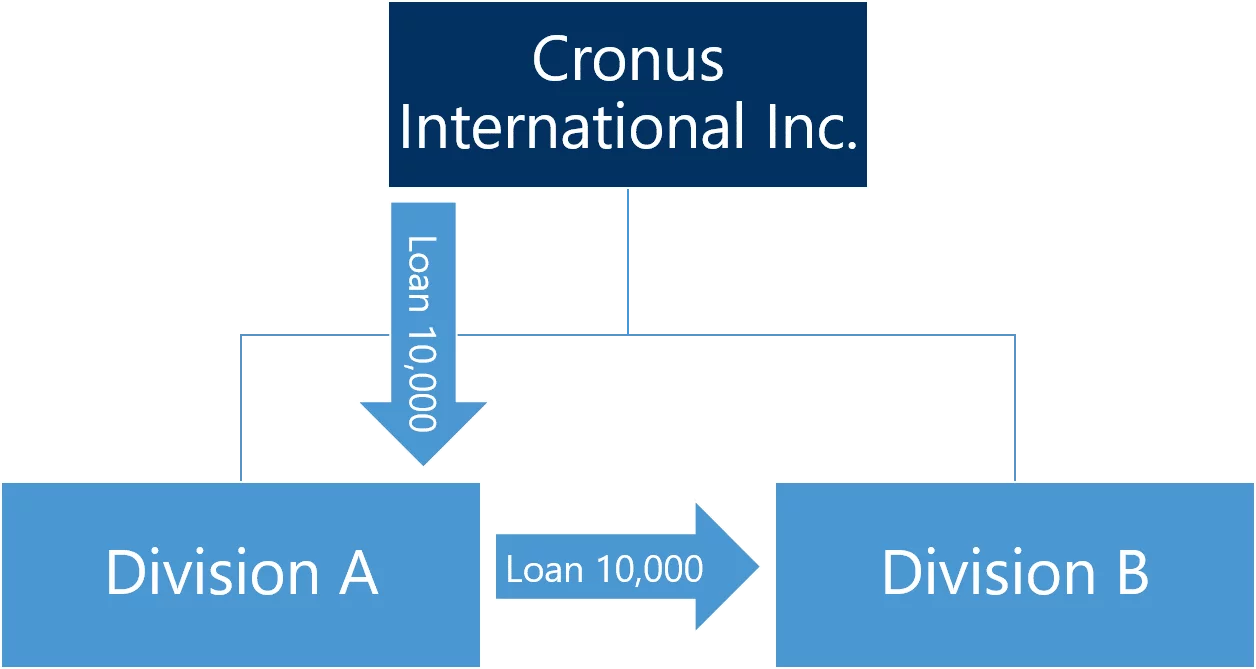

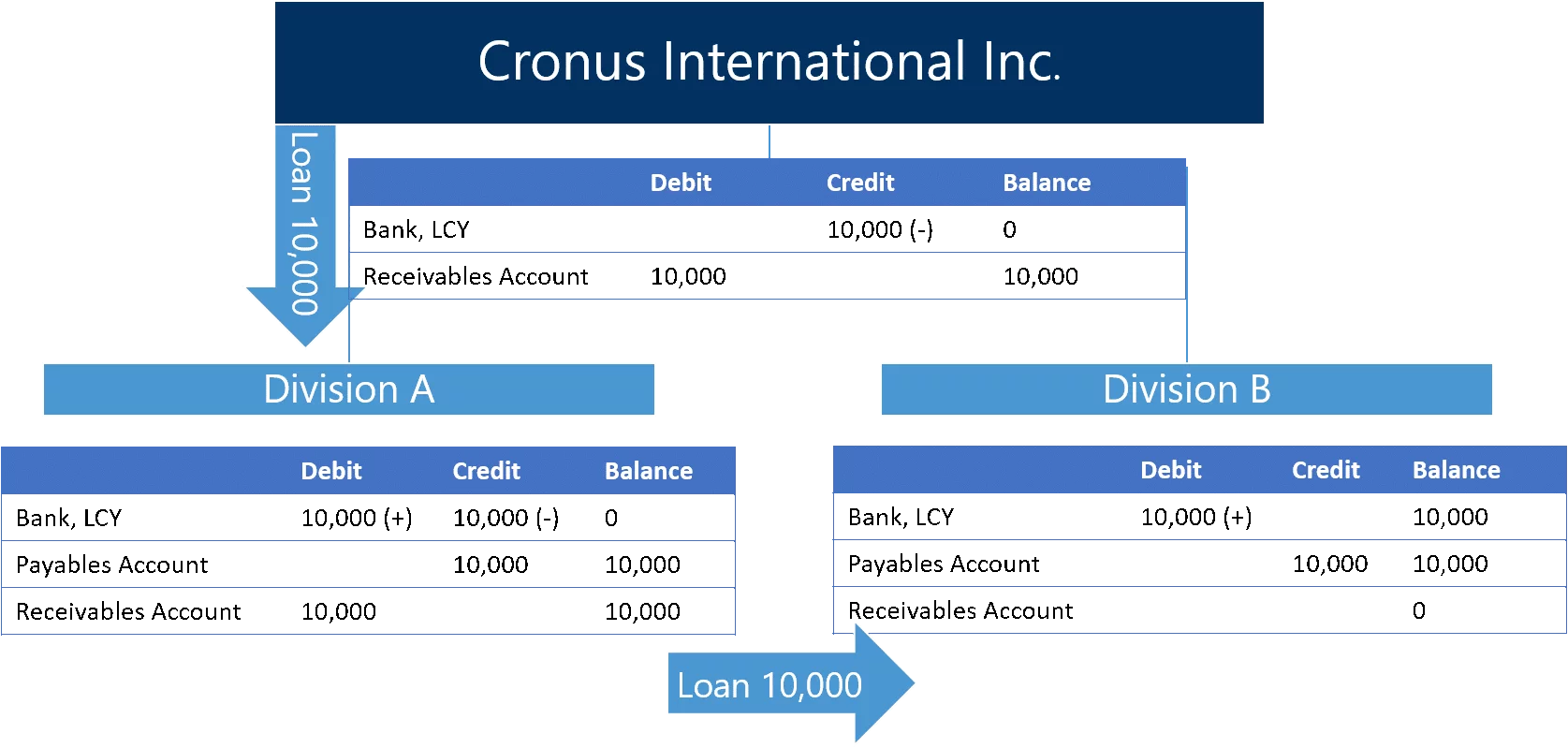

If the importance of tracking and eliminating intercompany transactions before performing consolidations is still not quite clear for you, consider a simple example. CRONUS International Inc. has divisions A and B, and each of these divisions records financial transactions separately. At first, Cronus International Inc. gives 10,000 loan to the Division A. The Division A does not spend the money, but transfers 10,000 loan further to the Division B.

The transactions will be recorded by the parent company and its divisions in the following way:

The receivables account is an asset account that reflects the amount of loan that was given and is expected to be returned back.

The payables account is a liability account that reflects the amount the borrower owes.

Let us assume that Division B did not spend the loan 10,000 which it received from Division A.

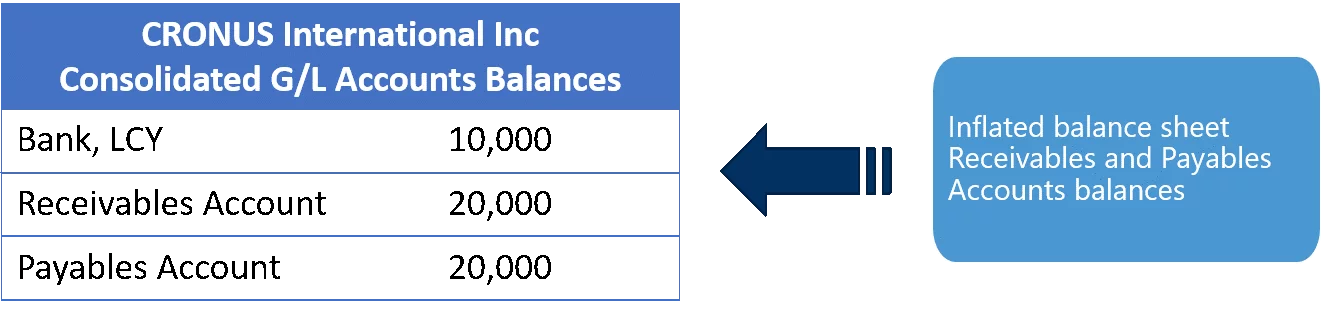

At the end of the year, if this type of transactions is not eliminated by the accountant, the balance sheet of the consolidated company CRONUS International Inc. will be inflated, since the consolidated company’s general ledger will contain both Receivables Account 20,000 balance and Payables Account 20,000 balance.

Imagine the extent to which the consolidated balance sheet may become unrealistically inflated if intercompany transactions turnover is millions worth.

In order to make it possible for the accountant to track intercompany transactions and make corresponding elimination adjustments in the consolidated financial statements, these transactions should be posted to special intercompany receivables and payables.

IC in Microsoft Dynamics NAV

In this article, we will review the ways we can use the Microsoft Dynamics NAV Intercompany functionality on the example of several business cases.

The setup for the IC functionality is easy and limited to registering of IC partner cards for all related companies and specifying your company IC partner code in the Company Information.

Note:

In Microsoft Dynamics NAV, the IC partner is not necessarily one of the business units that will be consolidated. The IC partner code can be assigned to vendors or customers for purposes of easy document exchange. In this cases standard customer/vendor posting setup will apply to receivables and payables (will be described later).

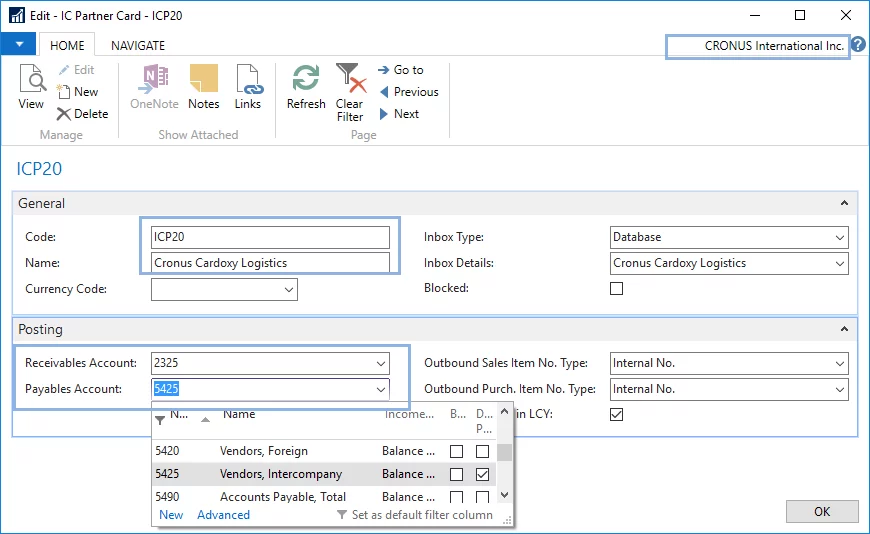

It is recommended that special intercompany payable and receivable accounts are created per IC partner and used for IC transactions posting. At the end of the year, the accountant will be able see the amount of the receivable and payables related to a particular IC Partner. Intercompany transactions can be posted using both purchase/sales documents or the IC journal.

We will review three cases of using the IC functionality to perform the following tasks:

- Sell or purchase on behalf of the partner companies and allocate sales or costs to the corresponding partner companies. Post Intercompany transactions to special IC Receivables and Payables accounts.

- Post Intercompany transactions to special IC Receivables and Payables accounts using IC general journal.

- Manage document or journal lines exchange between partnering companies to avoid mismatches in the amounts, posting time, etc. In this cases standard customer/vendor posting setup will apply to receivables and payables.

Case 1. Selling on behalf of an IC partner

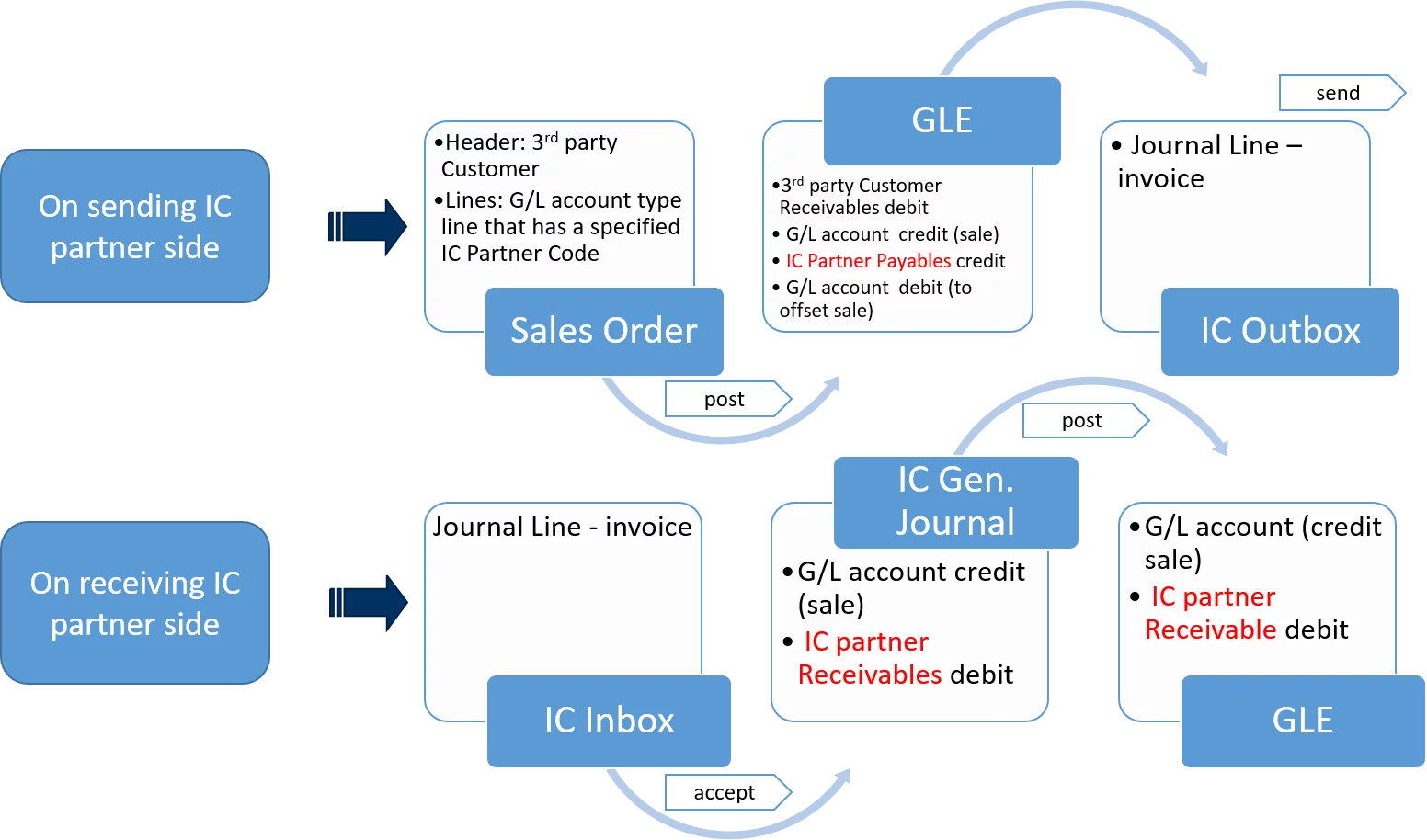

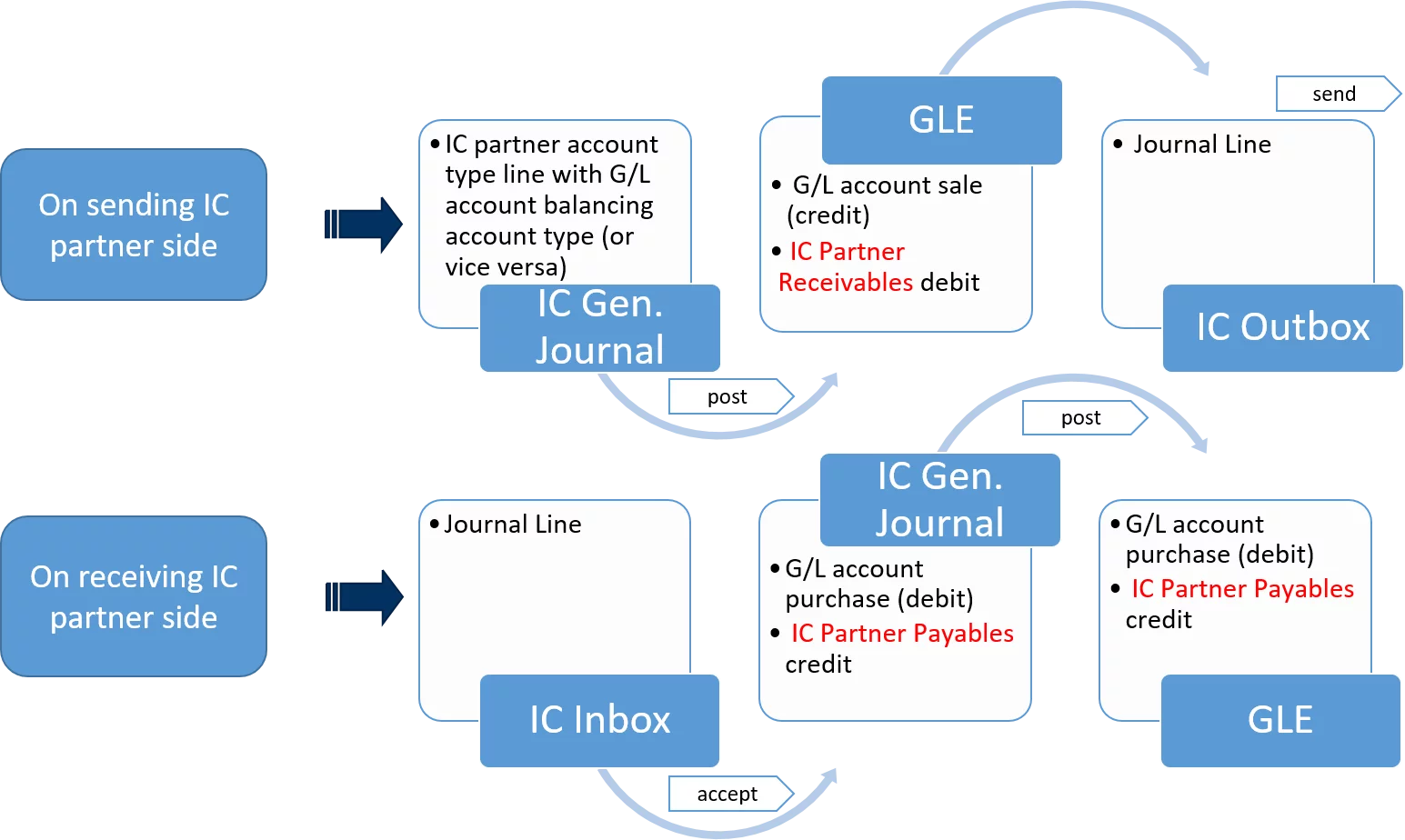

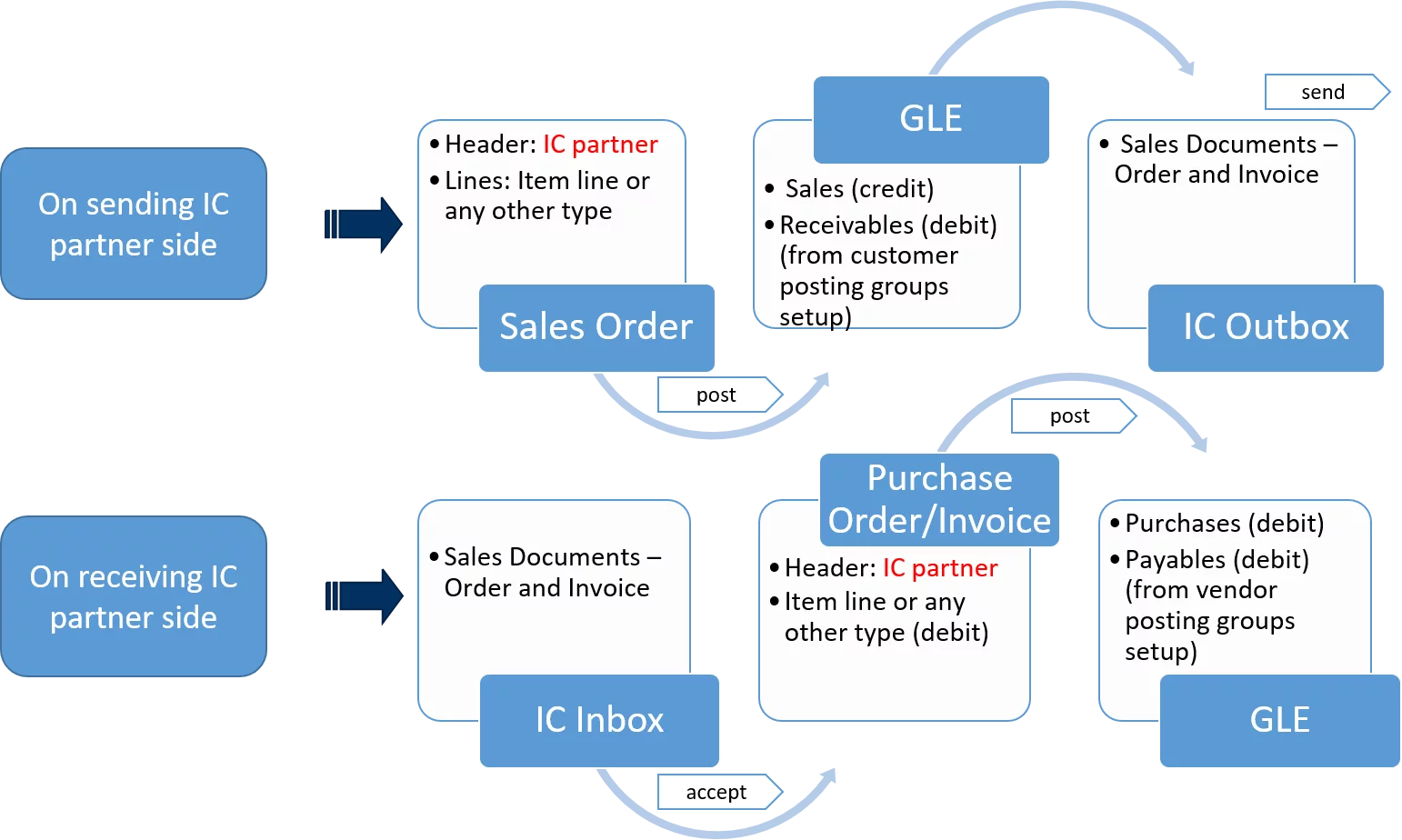

Below is the basic transaction flow which will be described in detail in this example.

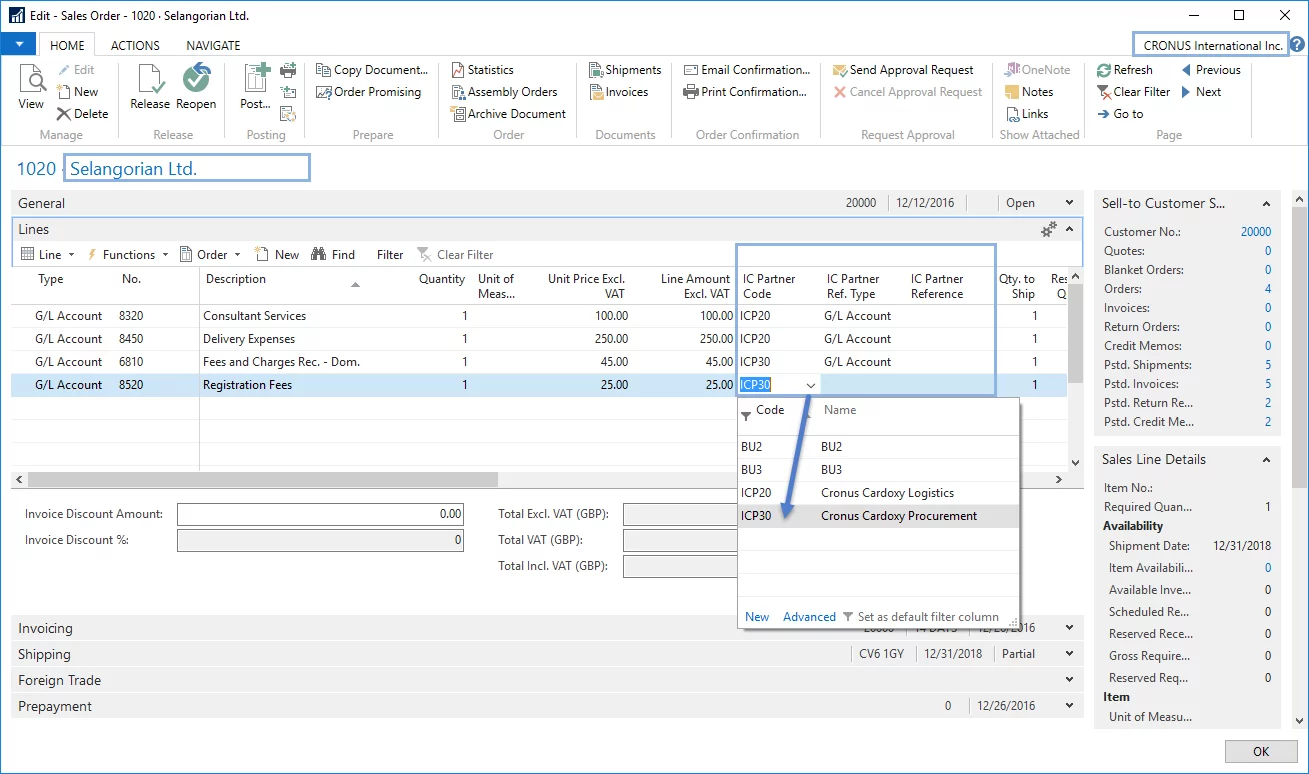

CRONUS International Inc. has two divisions: Cronus Cardoxy Logistics and Cronus Cardoxy Procurement. The divisions prepare independent budgets and perform independent financial accounting. Let us assume that CRONUS International Inc. provided goods delivery services to its customer Selangorian Ltd. The services were partially provided by both divisions of the parent company. However, the customer will be invoiced from Cronus International Inc. When Cronus International Inc. invoices the customer, there should be a way to allocate sales among its divisions.

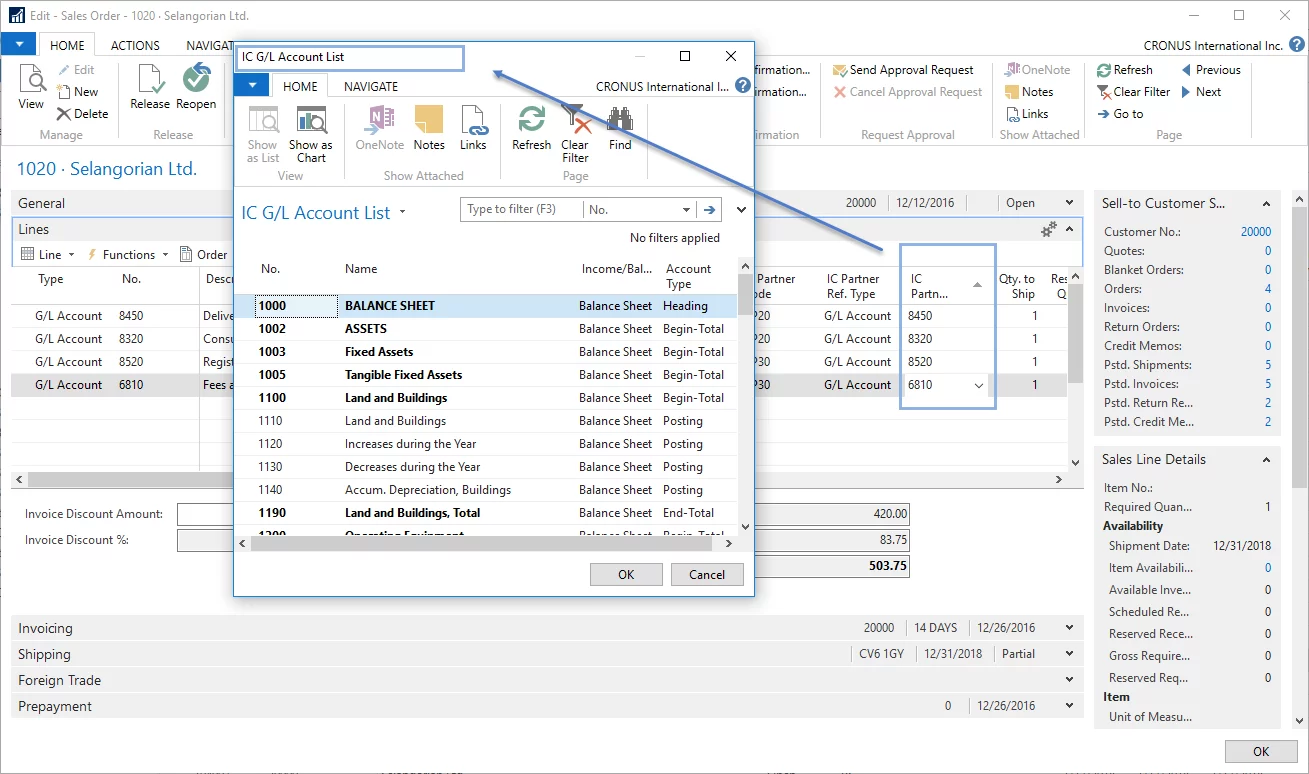

Let us create a sales order for the Salengorian Ltd. customer, and, on the lines, indicate the G/L lines for the services that are being sold. We have the possibility to allocate the sales lines to the company divisions that were registered as IC partners by simply specifying the IC partner code in the corresponding field. Make sure you have properly registered IC partners before posting intercompany documents. Next, we need to specify the IC account number to which amounts should be posted in the partner companies. By default, the IC G/L Account List contains all G/L accounts from the Chart of Accounts of the company in which you are posting the document.

After we have specified the IC partners to which the sales and costs should be allocated, and appropriate IC G/L accounts, we can post the document.

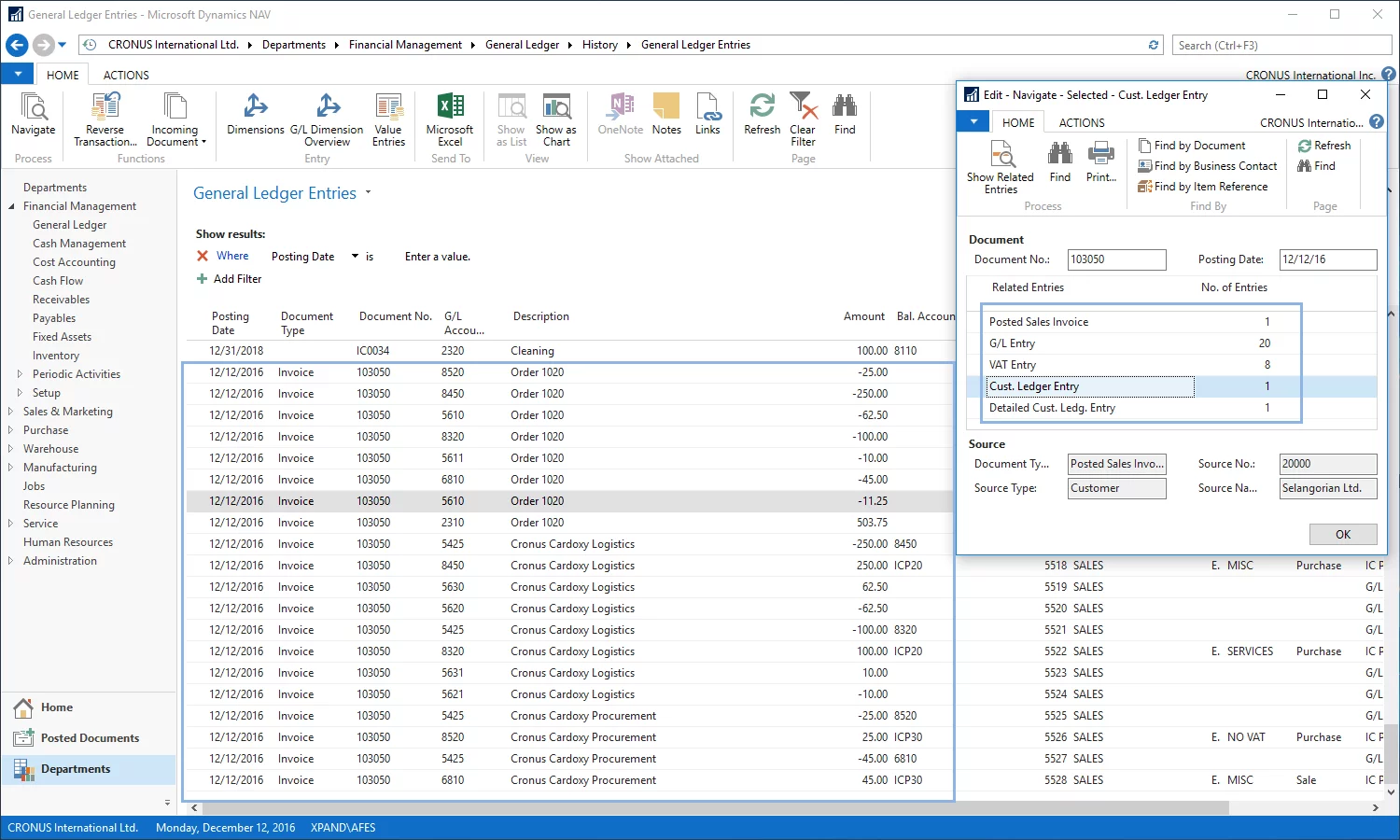

Let us look at the general ledger entries that have been created, since in this case they will be a little bit different from those that are created from regular documents.

Note that from just four lines in the sales order, twenty general ledger entries have been created, of which one customer ledger entry for Salengorian Ltd has been created.

Let us sum up what these entries represent:

- The entries to reflect sale of services balanced with the accounts receivables amount (from the customer Salengorian Ltd.).

- The entries to reflect purchase of services from the corresponding IC partners balanced with the intercompany payables account that was specified on the IC partner card for each of the partner company.

- VAT entries as per VAT posting setup.

The services are sold and purchased for the same amounts. Therefore, the net of transactions will not have any impact on the income statement of CRONUS International Inc.

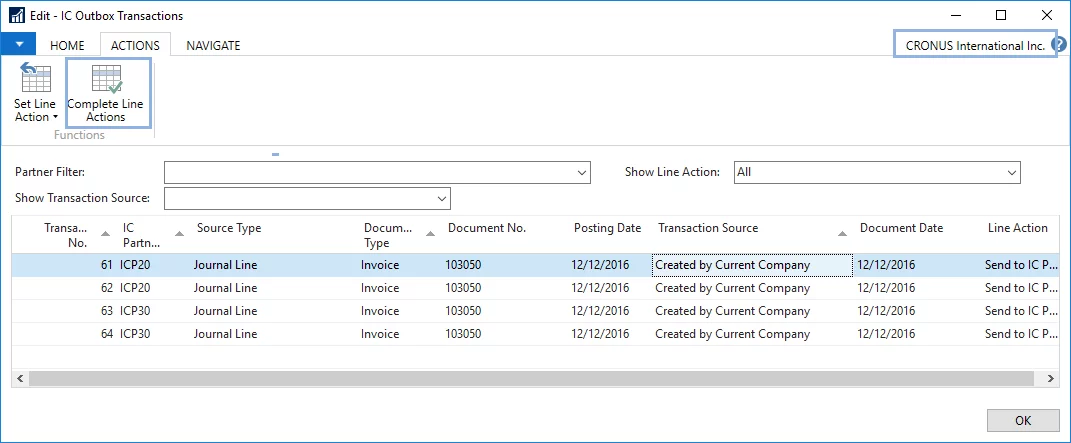

After we have posted the lines in which the IC partner was specified, these documents can also be found in the IC Outbox Transactions containing documents ready to be sent to the corresponding IC partners.

After the journal lines have been sent, you can receive them in the IC Inbox Transactions in the corresponding partner company.

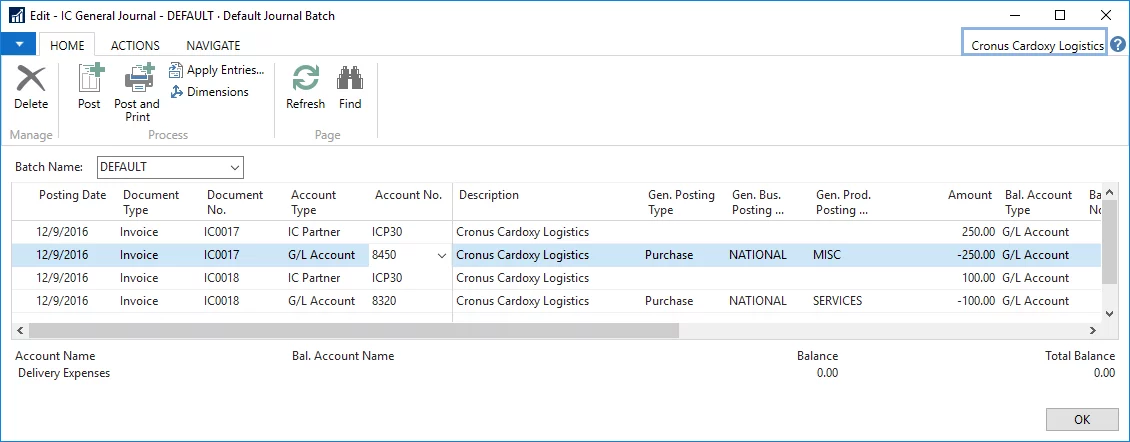

Accepted journal lines will create lines in the IC general journal per each G/L account line from the sales order that was posted in the parent company.

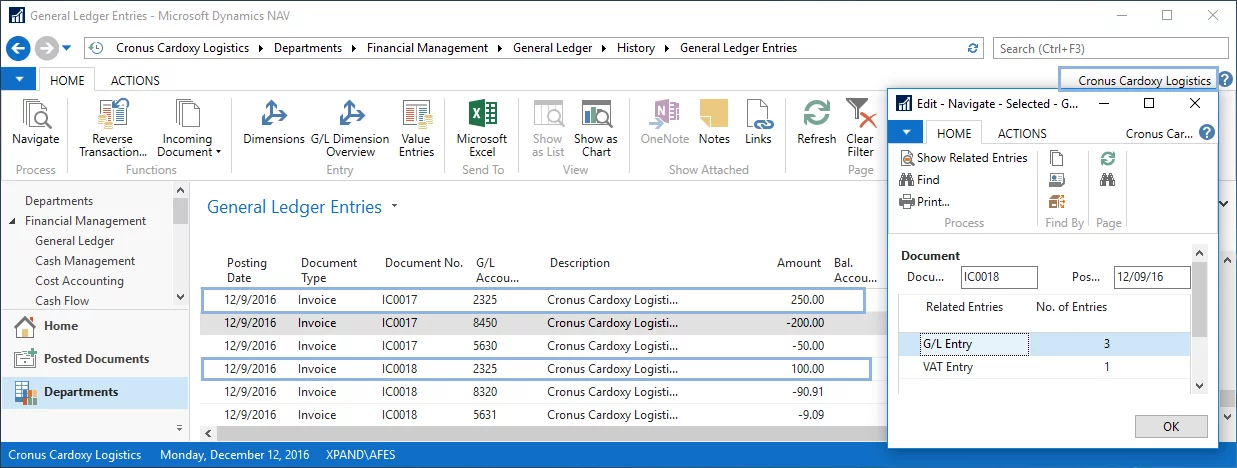

Let us post these lines and see which general ledger entries will be created in the IC partner - Cronus Cardoxy Logistics.

Let us sum up what these entries represent:

- VAT entries as per VAT posting setup.

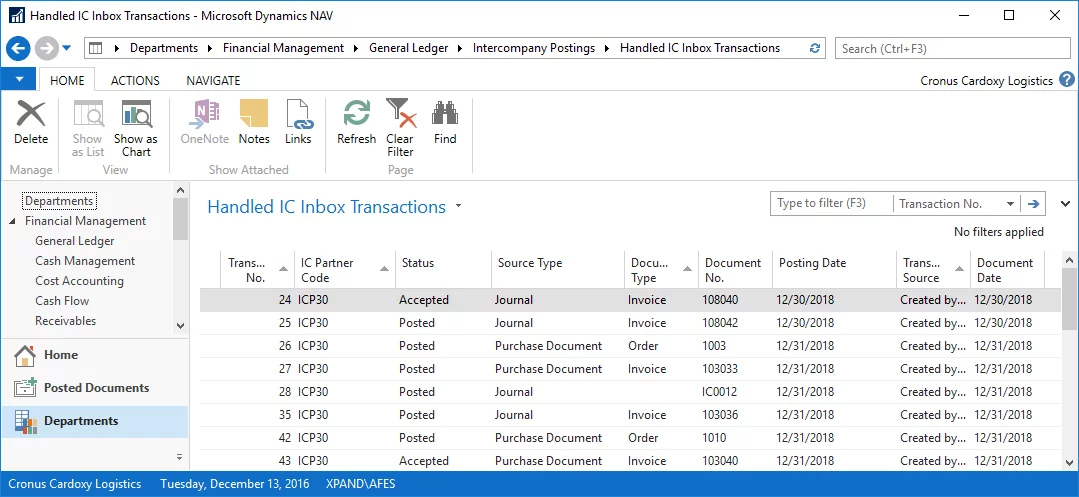

NAV registers all intercompany transactions that were sent or received and stores these records in the Handled IC Inbox Transactions and Handled IC Outbox Transactions.

The Intercompany accounts will accumulate the amounts resulting from such transactions that must be adjusted by the accountant later on to avoid balance sheet inflation.

Let us look at the general ledger entries that were created in the other division, Cronus Cardoxy Procurement.

Similar to Cronus Cardoxy Logistics, the transactions must be accepted in the IC Inbox Transactions and then posted in the IC general journal.

Case 2. Post IC transactions to IC Receivables and Payables using IC Gen. Journal

The two companies, CRONUS International Inc. and Cronus Cardoxy Logistics, are related companies, the general ledgers of which are periodically consolidated. In order to track IC transactions, the companies use the IC functionality. CRONUS International Inc. gives a loan in the amount of 10,000 to Cronus Cardoxy Logistics. Let us explore how this transaction can be recorded using the IC general journal.

Below is the basic transaction flow that will be described in the following example:

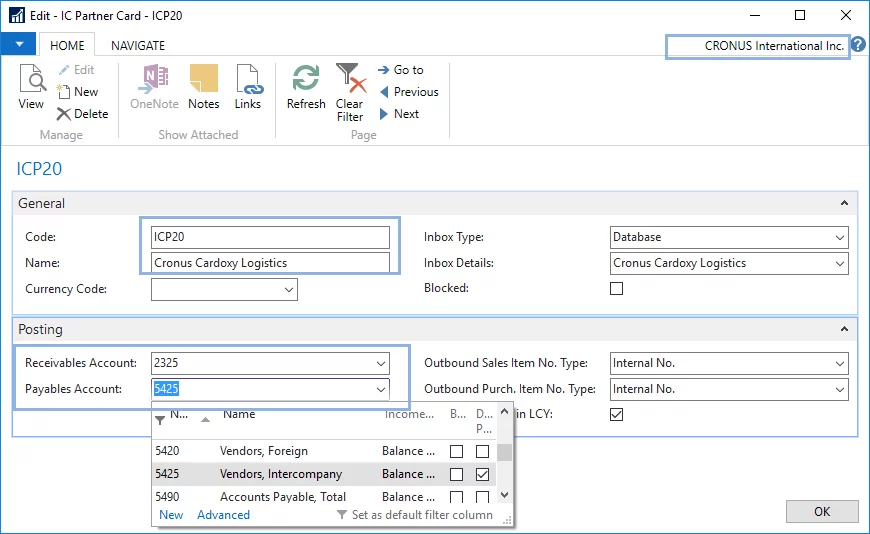

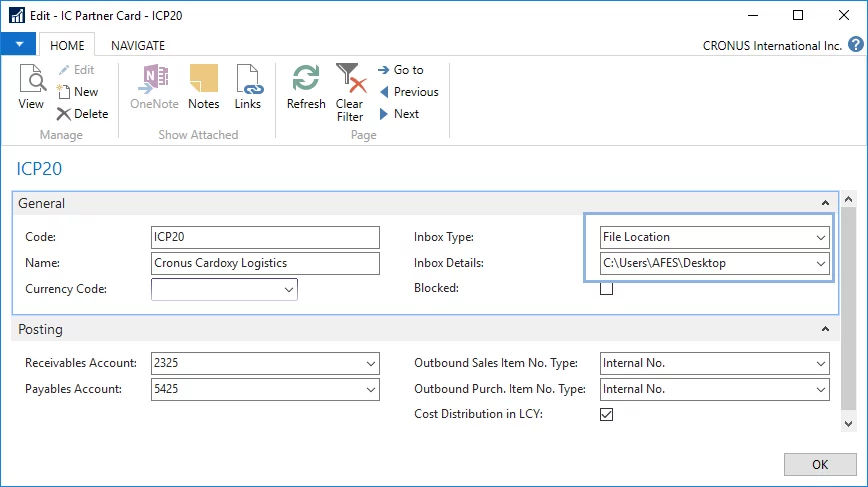

Create the IC Partner Card for the Cronus Cardoxy Logistics and specify the corresponding intercompany receivables account and payables account.

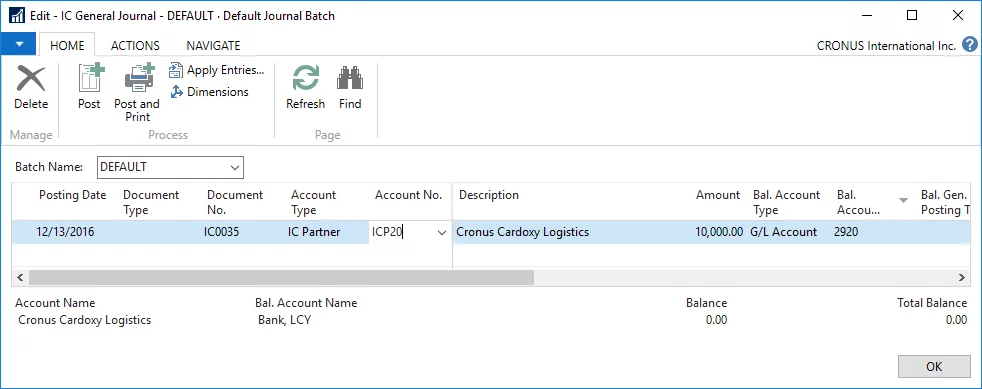

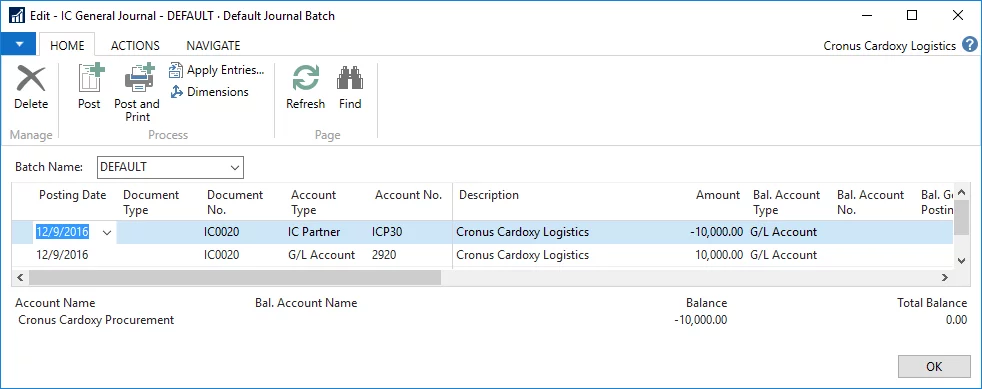

Let us now open the IC general journal and create a line to record the transaction.

In the Account Type field, choose IC partner, and in the Account No. field, choose the IC Partner code. Next, specify the amount and the balancing account, which in our example is Bank, LCY. Now we post the line and then view the general ledger entries that have been created.

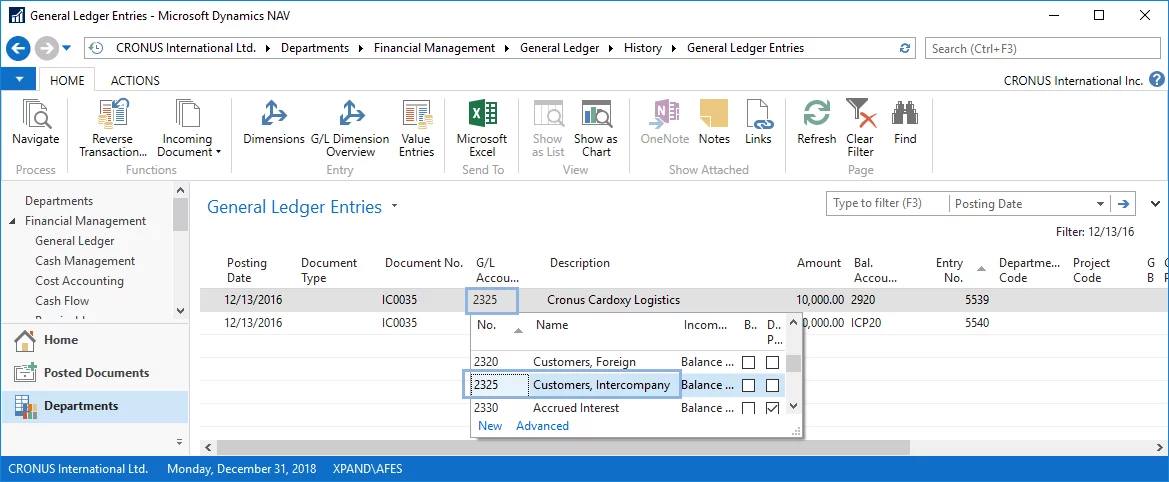

As the result of the posted IC General journal line, the receivables amount has been posted to the intercompany receivables G/L account we specified on the IC partner card earlier.

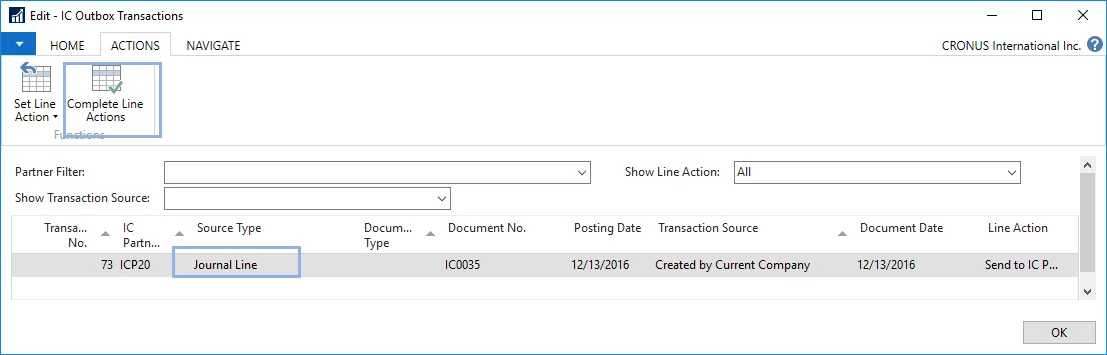

Additionally, the posted transaction can be also found in the IC Outbox Transactions ready to be exchanged with the partner company.

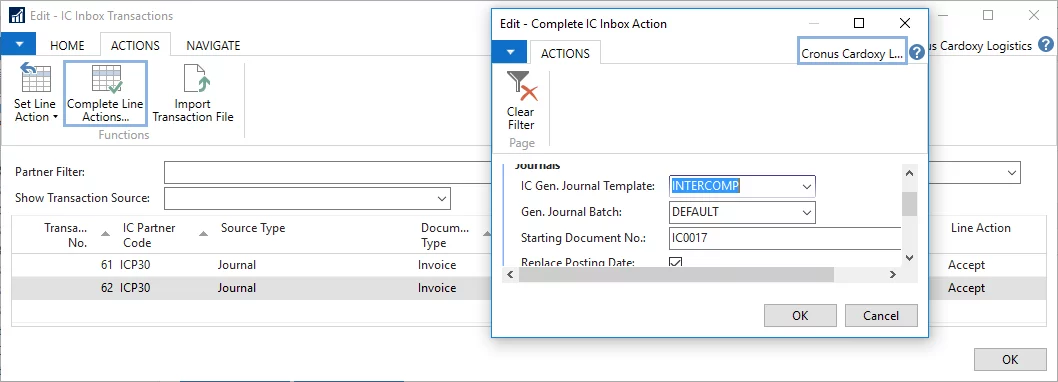

After we send the transaction to the IC partner, the partner company can find the transaction in the IC Inbox Transactions. Accepted transactions in the IC Inbox Transactions will create journal lines in the IC general journal. Since the transaction in CRONUS International Inc. was posted as credit to a bank account and debit to intercompany receivables account, the journal line in Cronus Cardoxy Logistics will be the opposite - debit amount to a bank account and credit amount to an intercompany payables account.

Case 3. Managing document exchange

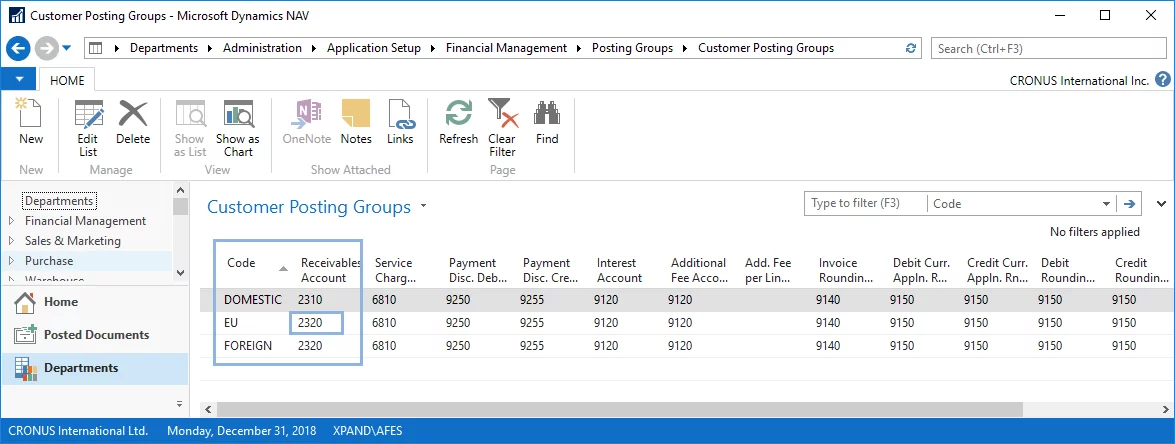

Let us analyze how the IC partner functionality can be used to simplify the intercompany documents exchange process and avoid any mismatches and mistakes. In this case, we will not imply arm-length transactions, but transactions between companies that are not related. The partner company will have an opportunity to post the documents without the need to reenter data. The IC partner code will be assigned to a customer and a standard customer posting setup will apply to receivables (NAV will ignore receivables and payables accounts specified on the IC partner card).

Below is the basic transaction flow that will be described in this example:

Let us assume that Cronus International Inc and Cronus Cardoxy Logistics use the IC functionality in order to exchange documents between each other, but are not related companies. Suppose the companies use an external shared folder to exchange documents (in this example, we will not bother to use an external folder though). In the Inbox details, specify the link to the folder where the XML file will be saved and accessed by the partner company. The partner company does not necessarily need to use Microsoft Dynamics NAV, any ERP system that can read XML files can receive IC transactions using this approach.

In this example, we will intentionally specify the receivables account and payables account just to point out that although specified, it will not be used by NAV for amount posting in this example.

Before posting any transactions, make sure you have registered the IC partner card and specified corresponding the IC partner code on the customer card.

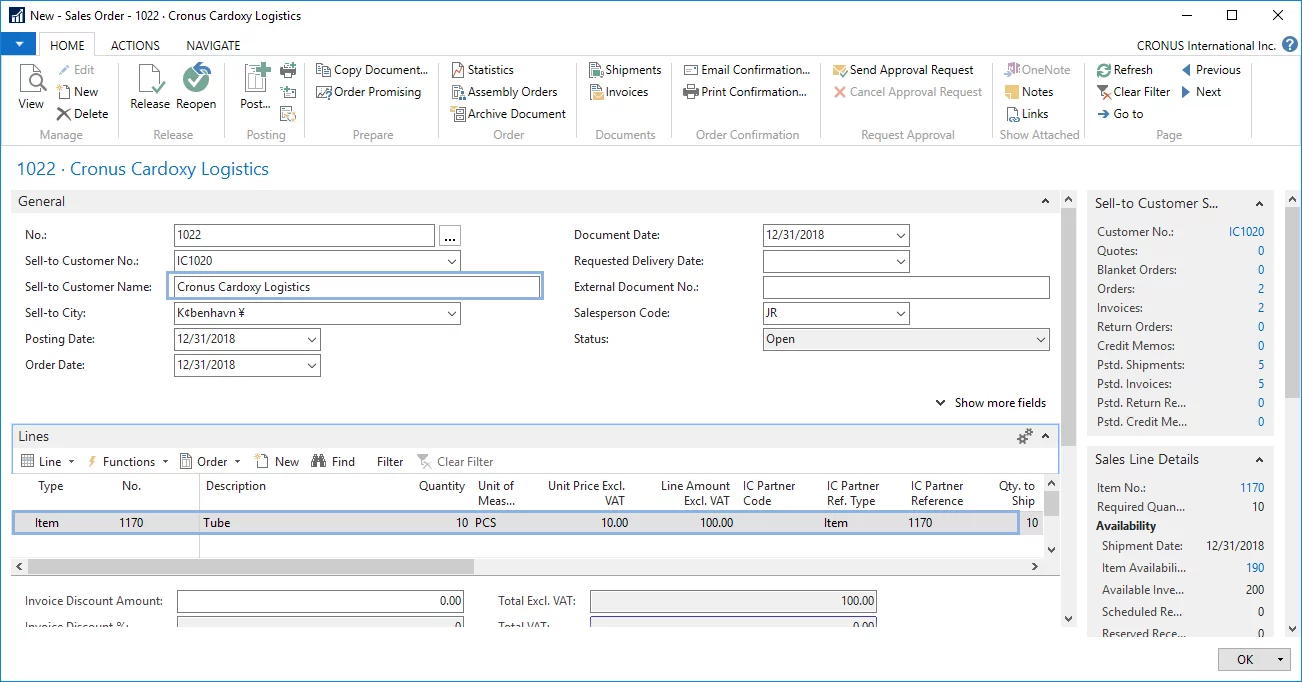

In our example, Cronus International Inc. sells 10 pieces of item Tube for 10 each (in the local currency) to its customer Cronus Cardoxy Logistics. In the sales order header, we specify the partner company to which the item is sold and create a corresponding sales line with 10 pieces of item Tube.

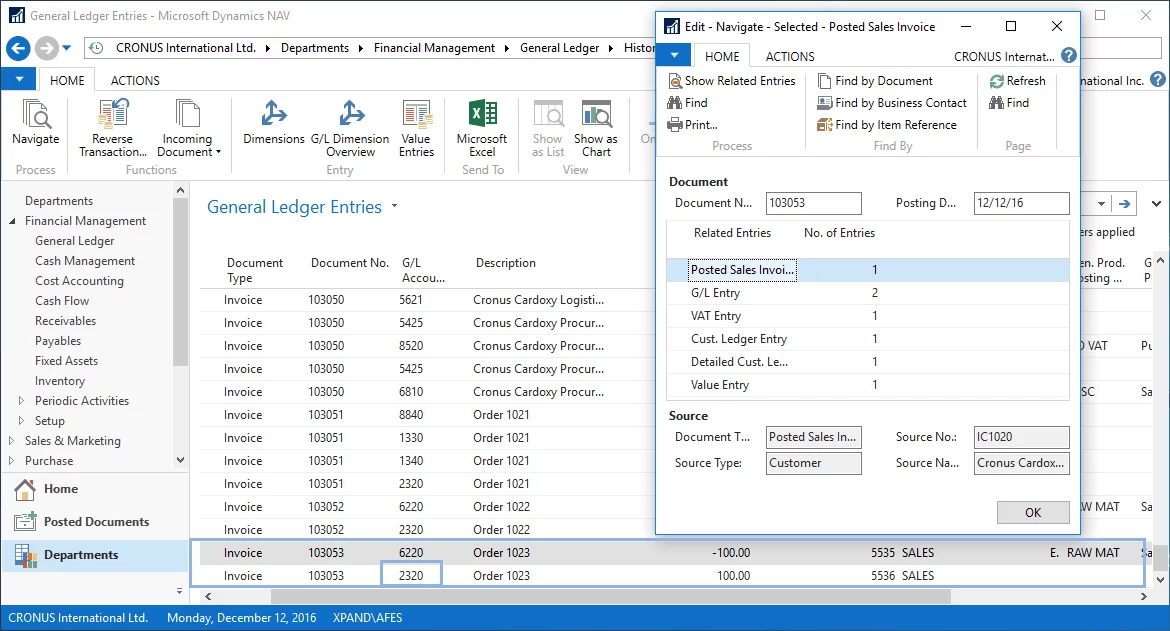

Let us post the document and look at the general ledger entries that will be created.

We can see these are just standard regular ledger entries that would be created for any customer. The IC partner status did not have an impact on the entry types. Note that the Receivable Account number specified on the IC partner card was not used for posted amounts. Instead, the regular account from the Customer Posting Groups setup has been used.

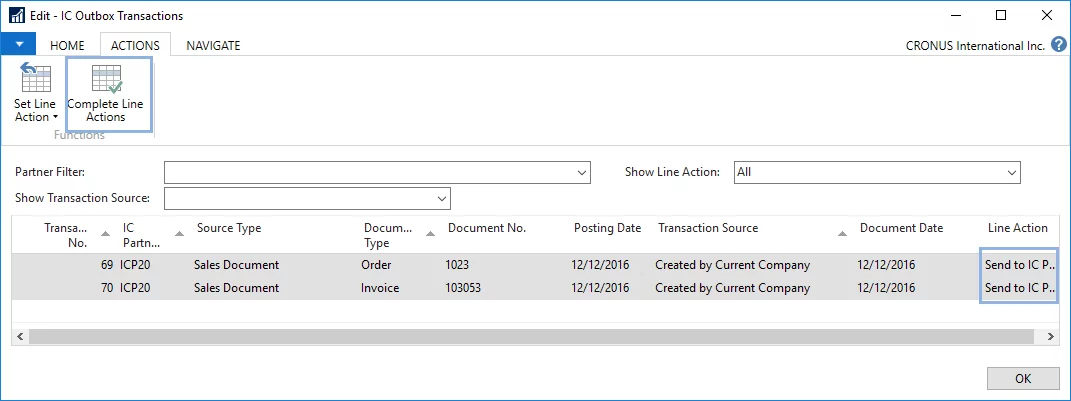

However, since the company has been resisted as IC partner, the posted sales order can be found in the IC Outbox Transactions ready to be sent.

The IC Outbox Transactions contains both the order and the invoice. Selecting the lines which are marked as Send to IC Partner and then choosing Complete Line Actions will create an XML file that will be exported to the location path specified on the IC partner card.

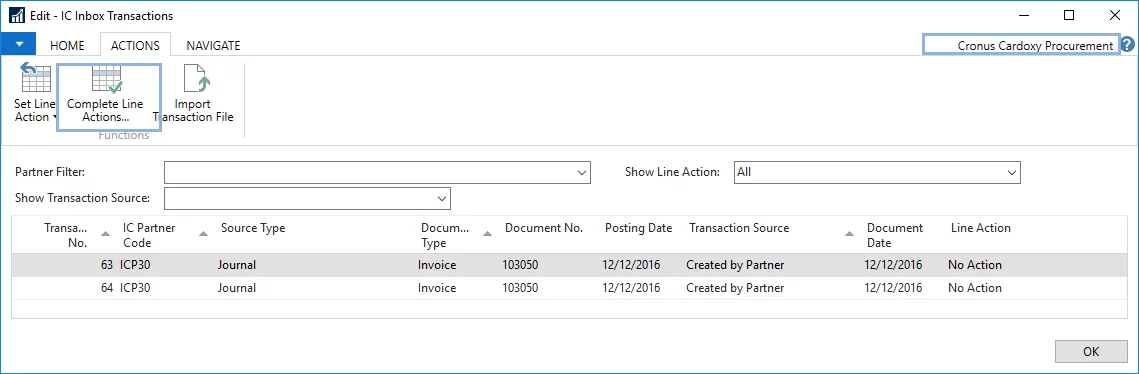

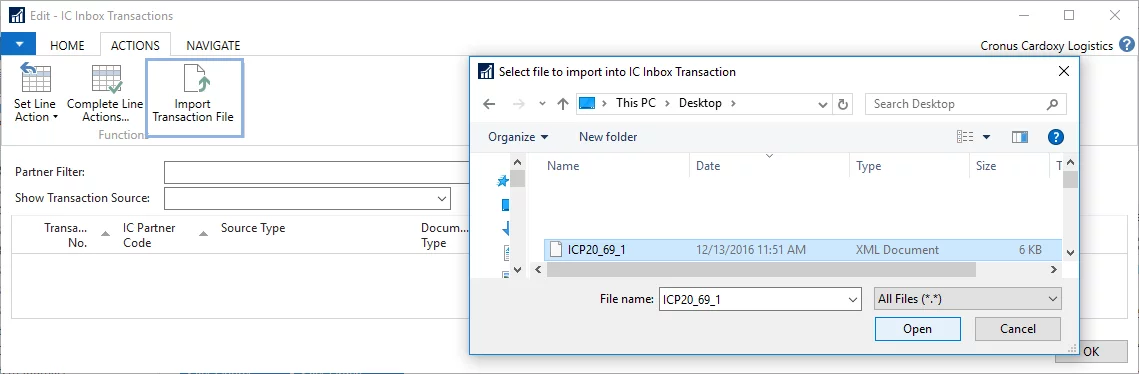

In order to receive the documents, the IC partner – Cronus Cardoxy Logistics – must import the XML file in the IC Inbox Transactions.

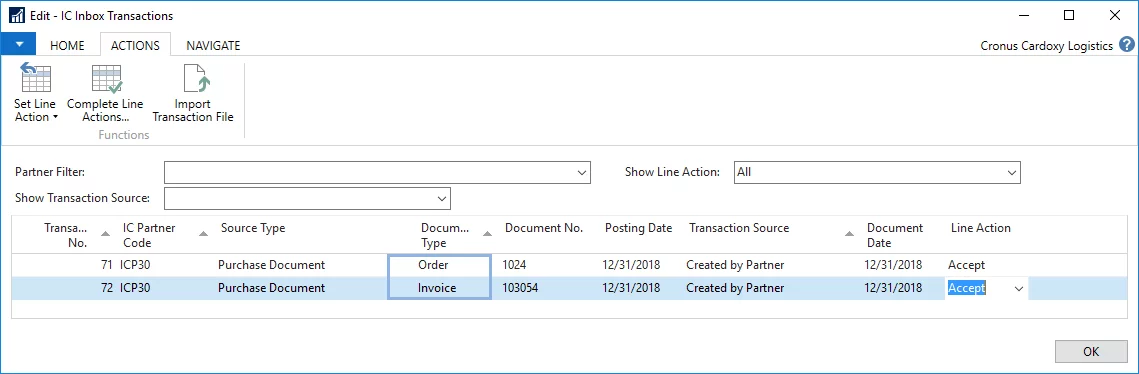

Import of the XML file will create order and invoice lines in the IC Inbox Transactions of the partner company.

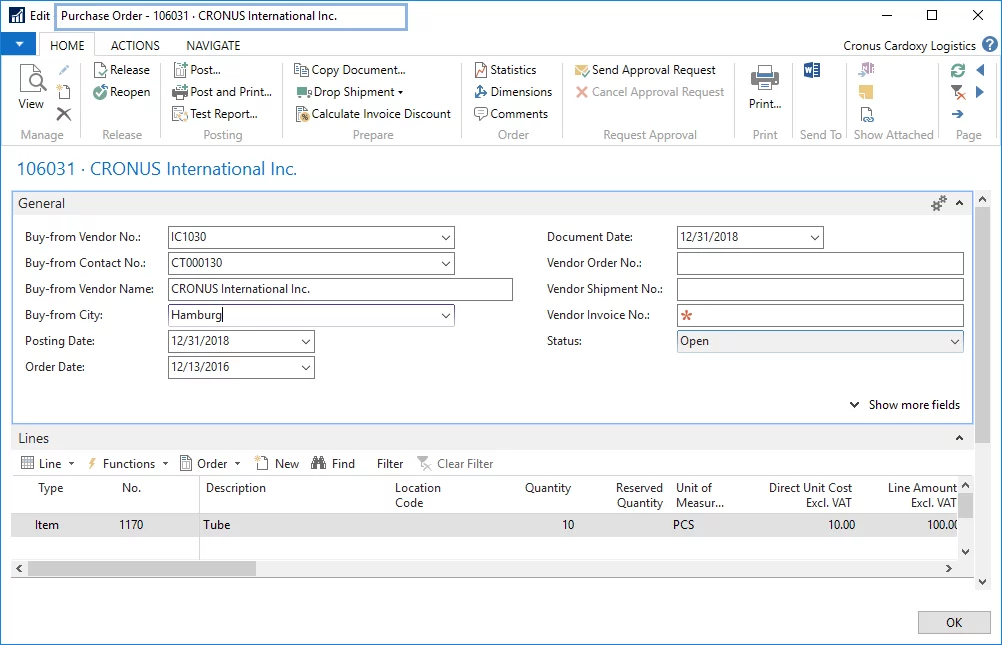

Accepted lines in the inbox in this particular case will create a purchase order and a purchase invoice.

Note:

NAV has transferred the opposite of the sales order and invoice - the purchase order and invoice documents.

Let us state the main points of IC functionality in Navision:

- The IC functionality can be used to track intercompany transactions in order to easily reconcile them and eliminate them during consolidation.

- The IC functionality allows transferring purchase and sales documents as well as journal lines to partners without the need for them to reenter data.

- The IC functionality can be used by companies that exist within the same database or separately.

- The IC functionality does not cover fixed assets intercompany transactions specifics.